Moving to Italy? Don’t miss out on the Special Tax Regime

Italy has historically faced emigration phenomena towards wealthier countries, leading to a loss of wealth and skills. To reverse this trend and stimulate economic growth, measures have been introduced to encourage non-residents to transfer their residence to Italy.

Article 24-bis of the Italian Income Tax Code (TUIR) introduces an optional substitute tax regime for individuals (and, potentially, their family members) who transfer their tax residence to Italy. This regime applies to income produced abroad.

Individuals eligible for this regime must:

- Transfer their tax residence to Italy,

- Have not been tax residents in Italy, for at least nine out of the ten tax years preceding the period when the option becomes effective.

According to paragraph 2 of the TUIR, the substitute tax on foreign income is set at €100,000 per tax year, regardless of the income amount. This amount is reduced to €25,000 per tax year for each family member.

However, recent amendments introduced by Article 2 of the Law Decree of August 9, 2024, n. 113, also known as the ”Omnibus Decree,” have increased the substitute tax to €200,000 for individuals transferring their residence to Italy after August 10, 2024.

Income generated abroad, subject to this substitute tax, is identified according to the criteria established by Article 165, paragraph 2 of the TUIR.

The foreign-sourced income covered by this regime includes:

- Real estate income from foreign lands and buildings,

- Capital income from foreign states or non-resident entities,

- Employment income earned abroad,

- Self-employment income derived from activities performed abroad through a fixed base,

- Business income from activities conducted through permanent establishments abroad,

- Capital gains from the sale of shares in non-resident companies,

- Other miscellaneous income from foreign activities and assets.

The option remains valid for 15 years and cannot be renewed after its expiration. Income generated in Italy remains subject to regular taxation.

During the valid tax years, individuals are exempt from:

- Filling out the RW section of the tax return,

- Paying the IVIE (property tax on foreign real estate) and IVAFE (financial assets tax).

Forvis Mazars is a global network operating in more than 100 countries. We have a close collaboration with our colleagues worldwide, which gives us the opportunity to help our customers in the best possible way. If you currently live in Italy or are planning to move there and have questions about how these rules may affect you, please reach out to us and we can assist with analyzing your specific situation.

Uppdaterade kommentarer från OECD om fast driftställe

I november 2025 beslutade OECD om en ny utgåva av modellavtalet samt en uppdatering av kommentaren till avtalet. Uppdateringen är det mest omfattande klargörandet kring fast driftställe på många år, och innebär tydligare regler om gränsöverskridande distansarbete. Distansarbete från annat land kan medföra fast driftställe för arbetsgivaren Distansarbete blir allt vanligare och kan skapa skatterisker […]

Gott nytt deklarationsår!

2026 har bara börjat men redan nu kan det vara bra att börja tänka på den kommande deklarationssäsongen, som gäller inkomståret 2025. Om du har fått en utdelning från ditt fåmansföretag eller gjort en större vinst under 2025, kan det vara läge att göra en extra inbetalning till skattekontot före den 12 februari för att […]

Så påverkar låneförbuden i ABL dig och ditt aktiebolag

Känner du till att ett förbjudet lån kan leda till återbetalningsskyldighet, skattemässiga konsekvenser och till och med straffrättsliga påföljder? Reglerna om låneförbud i aktiebolagslagen (ABL) är viktiga att ha koll på för dig som driver ett aktiebolag då de påverkar hur du kan agera som ägare, styrelseledamot eller VD. I den här artikeln går vi […]

Lagändringar som träder i kraft 1 januari 2026

Den 1 januari 2026 träder ett antal nya lagar och regler i kraft. Inom skatteområdet är det flera förändringar som vi vill lyfta fram och som påverkar både dig som företagare och privatperson. Skatt på arbetsinkomster Sänkt skatt på arbete och pension Jobbskatteavdraget och grundavdraget för pensionärer ska förstärkas, vilket innebär att personer med tjänsteinkomster […]

Nytt förhandsbesked från SRN: Ingen uttagsbeskattning vid fastighetsreglering från kommanditbolag

Den 7 oktober meddelade Skatterättsnämnden ett förhandsbesked (106/24-D) avseende uttagsbeskattning vid fastighetsreglering från ett kommanditbolag till dess komplementär. Förhandsbeskedet behandlar frågan om uttagsbeskattning kan ske när den kontanta ersättningen vid fastighetsreglering understiger 42 000 kr. Rättslig bakgrund Fastighetsreglering innebär att mark kan föras över från en fastighet till en annan genom myndighetsbeslut. Överföring av mark genom […]

Uppdatering den 3/12: Riksdagen har beslutat de nya 3:12-reglerna

Den 26 november 2025 godkändes regeringens förslag till ”enklare och bättre skatteregler för delägare i fåmansföretag” i samband med att riksdagen sa ja till utgiftsramarna och inkomsterna i budgetpropositionen för 2026. De nya 3:12-regelerna träder i kraft den 1 januari 2026 och tillämpas första gången för beskattningsår som börjar efter den 31 december 2025. Nedan […]

Lagen om tilläggsskatt (Pelare 2) – har du koll på tidsgränser att förhålla sig till?

Den 31 december 2023 trädde Lag (2023:875) om tilläggsskatt för företag i stora koncerner i kraft i Sverige. Lagen innebär att vissa stora koncerner omfattas av regler om global minimibeskattning – det så kallade Pelare 2-regelverket. Företag som omfattas av reglerna har särskilda uppgiftsskyldigheter gentemot Skatteverket och behöver vara väl förberedda för att kunna uppfylla […]

När blir man obegränsat skattskyldig i Sverige genom stadigvarande vistelse?

Den 8 juli 2025 meddelade Skatterättsnämnden ett förhandsbesked avseende hur man bedömer stadigvarande vistelse i Sverige för personer som bor utomlands men planerar regelbundna besök i landet. Frågan är aktuell för många som har fritidsbostad i Sverige eller planerar att vistas här under längre perioder, men som inte bor i landet permanent. Rättslig bakgrund Enligt […]

Statslåneräntan för 2025 är fastställd

Statslåneräntan är en referensränta som fastställs veckovis av Riksgälden. Den statslåneränta som gäller vid utgången av november används vid vissa skattemässiga beräkningar under hela nästkommande beskattningsår. Riksgälden har fastställt den statslåneränta som kommer att gälla den 30 november 2025. Statslåneräntan per detta datum har framför allt betydelse vid beräkningen av gränsbeloppet för kvalificerade andelar, schablonintäkten […]

Styrkan i Forvis Mazars globala nätverk

Forvis Mazars samlade skatteexperter från fem europeiska länder för ett exklusivt webbinarium om substanskrav och beskattningsrätt. Med fokus på ”Genuine Link” och praktiska utmaningar kring faktisk ledning, delade vi med av oss våra kunskaper och erfarenheter. Vi på Forvis Mazars visar återigen styrkan i vårt globala nätverk! Kollegor från Tyskland, Italien, Sverige, Storbritannien och Nederländerna […]

Förvaltningsrätten underkänner Skatteverkets bevisning i internprissättningsprocess mot Volvo

Förvaltningsrätten i Göteborg har i en dom från oktober 2025 (mål nr 7614-23 m.fl.) gett Volvo Personvagnar AB rätt mot Skatteverket i en omfattande tvist om internprissättning. Domen ger tydlig vägledning om beviskrav, funktionsanalys, jämförbarhetsstudier och markerar vikten av att Skatteverket faktiskt visar att felprissättning föreligger när det gäller koncerninterna transaktioner mellan svenska moderbolag och […]

Förslaget på nya ränteavdragsregler för företag – vart tog det vägen?

Regeringen har valt att inte gå vidare med förslaget till nya ränteavdragsregler för företag i årets budgetproposition. Vad innebär det? Jo, svenska företag kommer fortfarande behöva hantera svåra regler som styr deras rätt till avdrag för räntekostnader. I artikeln nedan sammanfattar vi ränteavdragsreglerna, de mest väsentliga förändringarna som låg på bordet, samt vad som är […]

Minskad skatt för begränsat skattskyldiga personer

Särskild inkomstskatt för utomlands bosatta, så kallad SINK, är en definitiv skatt för personer som är begränsat skattskyldiga i Sverige och som får utbetalning för arbete eller pension. Skatten har under många år uppgått till 25 procent, men nu föreslår regeringen att skatten ska sänkas – från 25 till 20 procent från och med 1 […]

Flera skattesänkningar i budgetpropositionen 2026

Den 22 september 2025 lämnade regeringen över budgetpropositionen för 2026, Prop. 2025/26:1, till riksdagen. Propositionen innehåller omfattande skattesänkningar för både privatpersoner och företag. Bland hållpunkterna återfinns ett stärkt jobbskatteavdrag, justeringar av regler för företag och investeringar, sänkt matmoms och punktskatter samt nya insatser för att minska skattefusk. I denna artikel ges en överblick av de […]

Nya 3:12-regler – här är det slutliga förslaget!

Den 22 september 2025 lämnade regeringen över budgetpropositionen för 2026 till riksdagen (Prop. 2025/26:1) – och med den flera stora förändringar av de omdiskuterade fåmansföretagsreglerna, de så kallade 3:12-reglerna. Syftet är att göra regelverket enklare och bättre anpassat till hur företag och ägarstrukturer faktiskt ser ut i dag, samtidigt som dess funktion att motverka inkomstomvandling […]

Företrädaransvar – vad innebär reglerna och är regeringens förslag en förbättring?

Företrädaransvar innebär att en företrädare för en juridisk person, exempelvis ett aktiebolag, blir betalningsansvarig för aktiebolagets obetalda skatter och avgifter. Det personliga betalningsansvaret kan riktas mot personer i företagets ledning, såsom dess styrelse, eller person som har den faktiska maktpositionen och möjligheten att påverka förvaltningen i företaget. Även en styrelsesuppleant som deltagit i styrelsearbetet eller […]

Mer pengar i plånböckerna – regeringens budgetförslag för 2026

Den 22 september 2025 överlämnar regeringen höstens budgetproposition för 2026 till riksdagen. Redan nu har flera reformer lagts fram – på en pressträff den 8 september presenterades ett paket med flertalet föreslagna åtgärder för att stärka hushållens ekonomi. Efter flera år av höga priser och pressad privatekonomi vill samarbetspartierna nu sänka skatter och avgifter med […]

Uppdatering: Lagrådsremiss om skattereduktion för företagsgåvor till ideell verksamhet

Regeringen presenterade den 26 juni 2025 en lagrådsremiss gällande skattereduktion för gåvor från juridiska personer till ideell verksamhet. Syftet är att skapa skatteincitament för företag som vill stötta sådan verksamhet, vilket bedöms bidra till samhällsnyttan. I remissen till Lagrådet föreslår regeringen att juridiska personer ska kunna få skattereduktion för gåvor till godkända ideella organisationer. Vi […]

HFD preciserar vad som avses med ”pengar” i bestämmelserna om andelsbyten

Högsta förvaltningsdomstolen (HFD) har prövat ett mål där frågan gällde innebörden av begreppet ”kontant betalning”. Närmare bestämt var frågan om även utfärdande av skuldebrev kan godtas vid tillämpning av bestämmelserna om framskjuten beskattning vid andelsbyten. HFD gör bedömningen att innebörden av uttrycket kontant betalning inte kan utsträckas till att avse betalningsarrangemang som innefattar annat än […]

Hur du säljer dina kvalificerade andelar i fåmansföretag utan att skatta

Om du som fåmansföretagare säljer dina kvalificerade aktier och får betalt med aktier i det köpande företaget kan du i vissa fall skjuta på beskattningen till framtiden. Tack vare reglerna om framskjuten beskattning kan ett s.k. andelsbyte emellanåt vara en riktigt god idé – förutsatt att förutsättningarna är de rätta. Varför göra ett andelsbyte? Det […]

Nya 3:12-regler – här är regeringens förslag!

Den 22 maj presenterade regeringen i en lagrådsremiss sitt förslag på förändringar i 3:12-regelverket. Lagrådsremissen överensstämmer i stora delar med Kommitténs förslag men med vissa förändringar. De ändrade reglerna föreslås träda i kraft 1 januari 2026. I maj 2022 beslutade regeringen att tillsätta en utredning i uppdrag att föreslå förenklingar av 3:12-reglerna. Kommittén överlämnade i […]

Ytterligare skatteförslag inför höstbudgeten

Den 19 maj presenterade regeringen flera skatteförslag inför höstbudgeten. Förslagen föreslås träda i kraft under 2026, men huruvida dessa förslag senare presenteras i höstbudgeten beror till stor del på det rådande ekonomiska läget. Sänkt elskatt För att minska elkostnaderna för hushåll och företag föreslås att energiskatten på el sänks till 41,4 öre per kilowattimme. Föreslaget […]

HFD delar Forvis Mazars uppfattning hur artikel 251 i tullkodex ska tolkas

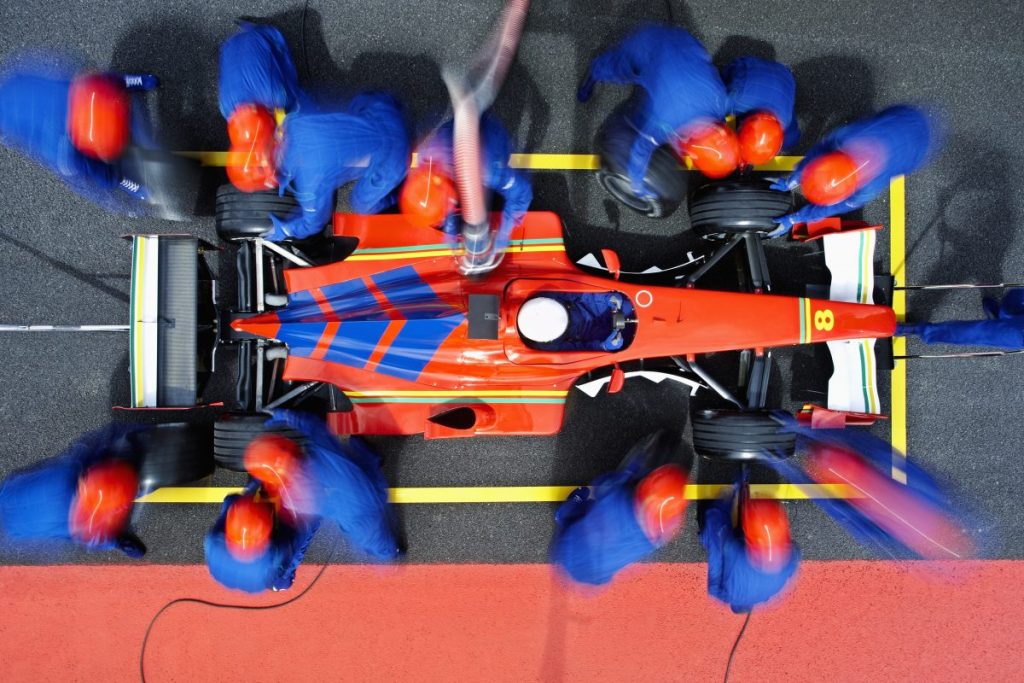

Ett företag påfördes tull och moms efter en tillfällig införsel av en dragracingbil. Fråga i Högsta förvaltningsdomstolen (HFD) har varit hur artikel 251 i tullkodex ska tolkas. Forvis Mazars processgrupp biträder företaget i processen. Ett bolag hade tagit in en dragracingbil på tillfällig införsel till Sverige. Syftet var att bolaget skulle tävla med bilen i […]

Kommissionen väcker talan mot Sverige – F-skattekrav anses hindra fri tjänstehandel för utländska entreprenörer

EU-kommissionen har beslutat att väcka talan mot Sverige vid EU-domstolen. Anledningen? Svensk skattelagstiftning har sedan 2021 krävt att uppdragsgivare drar av 30 procent preliminär skatt vid betalning till utländska entreprenörer för arbete som utförts i Sverige – om entreprenören inte är godkänd för F-skatt av Skatteverket. Enligt kommissionen bryter kravet om F-skatt mot EU:s grundläggande princip […]

The commission takes legal action against Sweden – F-tax requirement considered to restrict freedom to provide services for foreign contractors

The European Commission has decided to take legal action against Sweden at the EU Court of Justice. The reason? Since 2021, Swedish tax legislation has required clients to withhold 30% preliminary tax when paying foreign contractors for work performed in Sweden – if the entrepreneur is not approved for F-tax by the Swedish Tax Agency. […]

Den privata inkomstdeklarationen är inlämnad – vad händer nu?

De flesta inkomstdeklarationer för privatpersoner är nu inlämnade till Skatteverket. Vad händer nu? När kommer slutskattebeskedet och när ska eventuell kvarskatt vara betalad? Slutskattebeskedet Slutskattebeskedet innehåller en beräkning av den slutliga skatten och skickas ut av Skatteverket när deklarationen har hanterats. Slutskattebeskeden skickas ut vid olika tillfällen delvis beroende på när deklarationen lämnats in […]

Differentierad utdelning – möjligheter och fallgropar och hur du undviker dem

Att dela ut vinst från ett aktiebolag kan vid en första anblick verka enkelt – men ibland dyker komplexa frågor upp som kan kräva extra eftertanke. Kan man lämna olika utdelning för samma typ av aktier i ett bolag? Vilka konsekvenser kan detta i så fall få? Huvudregeln är att alla aktier i ett bolag […]

Deklaration för privatpersoner 2025 – Viktiga datum och saker att tänka på

Nu är det hög tid att börja förbereda sig för årets deklaration! När får du din deklaration? När ska den lämnas in? Hur undviker du ränta på kvarskatt? För många är deklarationen förknippad med frågor och osäkerhet, men vi har samlat de viktigaste datumen och informationen du behöver ha koll på inför deklarationen för inkomståret […]

Beskattning av vissa delägare i riskkapitalfonder – Tydligare spelregler och nya möjligheter

Den 28 januari 2025 publicerade finansdepartementet promemorian, Beskattning av viss avkastning från riskkapitalfonder. Förslaget syftar till att skapa en mer förutsägbar och tydlig beskattning av inkomster från särskild vinstandel, i linje med reglerna för kvalificerade andelar enligt 57 kap. inkomstskattelagen (1999:1229), IL. Bakgrund Frågan om hur fysiska personer som är verksamma riskkapitalstrukturer ska beskattas har […]

Modernisering och förenkling av skatteregler för arbetslivet på gång

De nuvarande reglerna för fastställande av tjänsteställets placering och reglerna om avdrag för ökade levnadskostnader uppfattas ofta som svårtolkade och oförutsägbara. I det nyligen publicerade betänkandet, Moderna och enklare skatteregler för arbetslivet (SOU 2025:4), presenteras föreslag till ändringar i skattelagstiftningen med syfte att förtydliga och modernisera regelverket, inte minst anpassa det efter dagens arbetsmarknad. Tjänsteställets […]

Viktiga datum för aktiebolagsdeklarationen

När det är dags att deklarera för 2024 finns det flera viktiga saker att tänka på. En felaktig eller försenad deklaration kan leda till skattetillägg och förseningsavgifter. För att undvika onödiga kostnader är det viktigt att känna till reglerna och lämna in deklarationen i tid. Viktiga datum att hålla koll på Skatteverket skickade ut inkomstdeklarationerna […]

Nytt förhandsbesked om anställds förvärv av optioner

Den 23 januari 2025 meddelade Skatterättsnämnden ett förhandsbesked (52-24/D) avseende anställds förvärv av optioner. Förhandsbeskedet behandlar frågan om huruvida ett förvärv av optioner ska klassificeras som värdepapper i den mening som avses i den s.k. värdepappersregeln och berör särskilt den rättsliga betydelsen av förfoganderättsinskränkningar i denna bedömning. Rättslig bakgrund Begreppet värdepapper är inte definierat i […]

Anser Skatteverket att du är personligt betalningsansvarig för ditt företags obetalda skatter?

Företrädaransvar innebär att en företrädare för en juridisk person, exempelvis ett aktiebolag, blir betalningsansvarig för aktiebolagets obetalda skatter och avgifter. Det personliga betalningsansvaret kan riktas mot personer i företagets ledning, såsom dess styrelse, eller person som har den faktiska maktpositionen och möjligheten att påverka förvaltningen i företaget. Även en styrelsesuppleant som deltagit i styrelsearbetet eller […]

Ny utredning om skatteincitament för forskning och utveckling

I Sverige finns ett antal skatteregler som syftar till att underlätta för svenska företag att attrahera och behålla kvalificerad arbetskraft. Till dessa hör reglerna om nedsättning av arbetsgivaravgifter och allmän löneavgift för personer som arbetar med forskning eller utveckling (det s.k. FoU-avdraget) och skattelättnad för utländska experter, forskare och andra nyckelpersoner (s.k. expertskatt). Under 2023 […]

Skattereduktion för företagsgåvor till ideell verksamhet – Nytt förslag från utredningen

Regeringen har mottagit ett delbetänkande från Utredningen om skatteincitament för juridiska personers gåvor till ideell verksamhet. I betänkandet föreslås att företag ska kunna få skattereduktion för penninggåvor till organisationer som är godkända av Skatteverket. Syftet med skattereduktion är att uppmuntra fler företag att bidra till samhällsnyttiga ändamål och stärka finansieringen av social hjälpverksamhet och vetenskaplig […]

EU-domstolen delar Forvis Mazars uppfattning hur artikel 251 i tullkodex ska tolkas

Ett företag påfördes tull och moms efter en tillfällig införsel av en dragracingbil. På fråga från Högsta förvaltningsdomstolen (HFD) har EU-domstolen den 12 december 2024 uttalat sig om hur artikel 251 i tullkodex ska tolkas. Forvis Mazars processgrupp biträder företaget i processen. Bakgrund Ett bolag hade tagit in en dragracingbil på tillfällig införsel till Sverige. […]

Hur hanteras utdelning till utländska aktieägare?

Kupongskatt är en källskatt som tas ut på utdelning från svenska aktiebolag när den som tar emot utdelningen är begränsat skattskyldig. Det är viktigt att ta hänsyn till när reglerna aktualiseras, vad som utgör utdelning samt om det finns undantag från reglerna för att det ska hanteras på rätt sätt. Om ett aktiebolag har lämnat […]

Skattelättnad för sponsring och gåva till ideell verksamhet

Regeringen har utvidgat en pågående utredning om skatteincitament för företagsgåvor till ideella verksamheter. Uppdraget omfattar nu även möjligheterna att införa skatteavdrag för sponsring. Juridiska personers gåvor till ideell verksamhet I juni 2023 tillsattes en särskild utredare som ska lämna förslag på skatteincitament för gåvor från juridiska personer till ideell verksamhet. Målet med utredningen är att […]

Julgåva till anställd – vad får den kosta?

Inför stundande högtider är det många arbetsgivare som ger sina anställda julgåvor eller bjuder in till julbord. Inför dessa festligheter vill vi upplysa och påminna om de skatteregler som tillämpas på sådana förmåner. I år har dessutom beloppsgränsen för skattefria julgåvor höjts i förhållande till tidigare år. Julgåva till anställda Julgåva till en anställd är […]

Vill du undvika eller hantera en skatteprocess? Ta hjälp av Forvis Mazars processgrupp!

I samband med att Skatteverket granskar en deklaration som du eller ditt bolag lämnat in kan det bedömas att uppgifter i deklarationen är felaktiga eller att information saknas för en korrekt bedömning. Det kan innebära att det föreligger en oriktig uppgift. En sådan uppgift kan ligga till grund för såväl skattetillägg som för anmälan om […]

Establishment of an entity in Italy and tax implications for employees

Are you planning to expand your business outside of Sweden? Starting a business abroad can be challenging and requires careful planning and understanding of the other country’s laws, rules and norms. Some parts in running a business in another country may be similar to Sweden, others not. In this article we focus on Italy – […]

Är du också en av många fåmansföretagare som betalar för mycket i skatt?

Att vara företagare i Sverige är inte så krångligt som många personer gör gällande. Men visst, det finns ett och annat att hålla reda på. Det handlar dock inte bara om att lämna korrekta uppgifter till myndigheterna. Man bör också säkerställa så att man som delägare i ett fåmansföretag maximerar sina möjligheter till lågbeskattad utdelning. […]

Vad tycker remissinstanserna om förslaget på förenklade fåmansföretagsregler?

Finansdepartementets lagförslag ”Förenkla och förbättra!” (SOU 2024:36), har varit ute på remissrunda och vi på Forvis Mazars har djupdykt i svaren från några viktiga remissinstanser – Skatteverket, FAR, Näringslivets Skattedelegation & Svenskt Näringsliv. Förslaget syftar till att förenkla reglerna för utdelning och kapitalvinst på andelar i fåmansföretag. Vi har tidigare sammanfattat lagförslaget i ett blogginlägg […]

Ett steg närmare ett nytt Öresundsavtal

Den 10 juni i år undertecknade Sveriges och Danmarks regeringar ett nytt bilateralt avtal som ska ersätta det så kallade Öresundsavtalet från 2003, vilket vi skrivit om tidigare. Sent i förra veckan lämnade regeringen sin proposition i vilken ändringar i lagen om dubbelbeskattningsavtal mellan de nordiska länderna föreslås. Även den så kallade SINK-lagen, lagen om […]

Vikten av att upprätta en Transfer Pricing policy

Transfer Pricing är skatteområdet som styr prissättning av koncerninterna gränsöverskridande transaktioner. När varor, tjänster eller immateriella tillgångar överförs eller upplåts mellan företag inom samma koncern, måste dessa transaktioner ske på marknadsmässiga villkor. Samtidigt fortsätter frågan att stå högt på agendan för skattemyndigheter. Lokala skattemyndigheter i respektive land måste se till att företagens skattebas inte urholkas […]

Så påverkas du som företagare av budgetpropositionen 2025

Den 19:e september presenterade regeringen budgetpropositionen för 2025. Nedan listar vi fem viktiga förändringar som kan påverka dig som företagare. Sänkt ersättningsnivå för expertskatt Expertskattereglerna som ger skattelättnader för utländska experter, forskare och nyckelpersoner förändras för att stärka Sveriges internationella konkurrenskraft. Regeringen föreslår att ersättningsnivån sänks från två till en och en halv gånger […]

Ränteavdragsreglerna i fokus – i väntan på remissvar

Innan sommaren publicerades utredningen ”Förbättrade ränteavdragsregler för företag”, SOU 2024:37. Utredning tillsattes som en uppföljning av de omfattande ränteavdragsregler som infördes 2019. Här sammanfattar vi de mest väsentliga ändringsförslagen. Koncernutjämning av räntenetto Idag beräknas räntenetto och avdragsunderlag för varje företag inom en koncern. Det är möjligt att koncernutjämna genom att kvitta ett företags positiva räntenetto […]

Förslag om avtrappat ränteavdrag för lån utan säkerhet

I slutet av augusti publicerades en lagrådsremiss där regeringen har föreslagit nya regler som innebär en utfasning av rätten till ränteavdrag på lån utan säkerheter. Utfasningen föreslås ske under en period om två år och förslaget kommer att ingå i budgetpropositionen för 2025. Enligt nuvarande regler ska fysiska personer, med vissa begränsningar, dra av ränteutgifter […]

Inkomstdeklarationen är inlämnad – vad bör du tänka på?

Inkomstdeklarationerna för 2023 är inlämnade och de flesta privatpersoner har nu fått sina slutskattebesked. För att klargöra eventuella oklarheter har Forvis Mazars i denna artikel samlat information om viktiga punkter samt datum som är bra att ha koll på när det gäller efterverkningarna av ditt slutskattebesked. Slutskattebeskedet Slutskattebeskedet innehåller en beräkning av den slutliga skatten […]

Nya regler från och med 1 juli 2024

Den 1 juli 2024 träder ett antal nya lagar och regler i kraft. Inom skatteområdet är det tre förändringar som vi vill lyfta fram och som påverkar både dig som företagare och privatperson. Ränta på skattekontot Räntan på skattekontot knyts till en basränta som följer det allmänna ränteläget. I och med att styrräntan nu sänks, […]

Oskäligt lång handläggningstid medför befrielse från påfört skattetillägg

Forvis Mazars processgrupp är en av Sveriges mest framgångsrika processgrupper med flera vinster i Högsta förvaltningsdomstolen (HFD). Den 11 juni 2024 meddelade domstolen dom ett mål avseende skattetillägg där Forvis Mazars var ombud för den klagande. 2018-07-19 beslutade Skatteverket ett antal skattekonsekvenser för ett bolag. En av dessa var att påföra bolaget skattetillägg. Skatteverkets beslut […]

Nya regler föreslås för FÅAB-delägare

Den 3 juni 2024 presenterade Kommittén om förenklad beskattning av ägare till fåmansföretag sitt betänkande. De ändrade reglerna föreslås träda i kraft 1 januari 2026 och innebär ändringar vid beräkning av lågbeskattat gränsbelopp för delägare i fåmansföretag. Målet med utredningen har varit att förenkla och förbättra de s.k. 3:12-reglerna i Inkomstskattelagen, d.v.s. reglerna för […]

FASTER – Enklare och effektivare hantering av källskatt över gränserna

Reglerna i det nya direktivet, FASTER, ska uppmuntra gränsöverskridande investeringar, förbättra kapitalmarknadsunionens funktion och bidra till effektivare bekämpning av skattebedrägerier. Syftet är att långsiktigt gynna hela ekonomin. Den 14 maj 2024 antogs direktivet FASTER (Faster and Safer Relief of Excess Withholding Taxes) av Ekofinrådet. Förslag till direktivet, som presenterades i juni förra året, syftar att […]

Regelverken som träffar företag i stora koncerner

Särskilda krav ställs på företag i stora koncerner när det kommer till skatterapportering och dokumentation. Sedan EU:s medlemsstater beslutade om ett direktiv för att införliva de modellregler som OECD presenterat om en global minimibeskattning, även känt som Pelare 2, har stor uppmärksamhet givits det nya regelverket som idag är en del av svensk lagstiftning. De […]

Remitterade skatteförslag inför höstbudgeten

Inför den kommande budgetpropositionen för 2025 har Finansdepartementet remitterat flera förslag till skatteförändringar. Beslutet om vilka förslag som faktiskt kommer att presenteras i höstbudgeten beror på bland annat det ekonomiska läget, reformutrymmet och finansieringsbehovet, samt de överläggningar som förs i det slutliga arbetet med höstbudgeten. Några av de intressanta förslagen är bland annat: Sänkt ersättningsnivå […]

Nytt Öresundsavtal stärker gränspendling – möjligheter ökar för distansarbete

Nytt avtal underlättar distansarbete mellan Sverige och Danmark och förbättrar villkoren för gränspendlare. Det uppdaterade Öresundsavtalet, som planeras träda i kraft 2025, reflekterar den nya arbetsverkligheten. I takt med att arbetsvärlden förändras, anpassas nu också avtalen som styr gränspendlingen i Öresundsregionen. Förändringar har länge varit efterlängtade och de förändrade arbetsmönstren under Corona-pandemin tydliggjorde behovet av […]

Skattenyheter i vårpropositionen för 2024

Den 15 april presenterade regeringen 2024 års ekonomiska vårproposition. Mot bakgrund av en fallande inflation och en stigande arbetslöshet framgår i propositionen åtgärder med syfte att ta oss igenom den rådande lågkonjunkturen, värna om välfärden samt främja trygghet och ekonomisk tillväxt i Sverige. I den här artikeln redogörs översiktligt för de riktlinjer som anges i […]

Hur ska kryptovaluta deklareras?

Handel med kryptovalutor har blivit allt vanligare de senaste åren, men det kan vara svårt att veta hur kryptotransaktioner ska deklareras. Vi på Mazars kan hjälpa dig. Handel med kryptovalutor har blivit allt vanligare de senaste åren och det uppstår många frågor hur sådana transaktioner ska beskattas och deklareras. När du ska deklarera en kryptotransaktion […]

Storbritannien avskaffar de förmånliga skattereglerna för personer med hemvist utanför landet

Den 6 mars 2024 annonserade Storbritannien i sin vårbudget att man har för avsikt att avskaffa de nuvarande, förmånliga, beskattningsreglerna för s.k. ”Residents non-domiciled” eller ”non-dom”. Reglerna gäller för privatpersoner bosatta i Storbritannien men som saknar särskild skattemässig hemvist i landet. Reglerna ska i stället ersättas med ett nytt, bosättningsbaserat, skattesystem. Förändringarna föreslås gälla från […]

Utomståenderegeln anses inte tillämplig vid både direkt och indirekt ägande

I slutet av februari kom Skatterättsnämnden med ett, nu överklagat, förhandsbesked (70-23/D) angående utomståenderegeln och samma eller likartad verksamhet. Frågorna i förhandsbeskedet grundande sig i att sökandena planerat att ta en större utdelning från bolaget under närliggande år och utmynnande i ett oenigt avgörande avseende vilka andelar som skulle beaktas vid beräkning av det utomstående […]

Portugals nya regelverk – detta gäller efter avskaffandet av NHR-reglerna

Från och med årsskiftet 2023/2024 avskaffades Portugals Non-Habitual Resident Regime, de så kallade NHR-reglerna. Nu har en ersättare skapats, som antogs från och med den 1 januari 2024, och som riktar sig till de som arbetar med vetenskaplig forskning och innovation. Mazars har tidigare skrivit inlägg om avskaffandet för NHR-reglerna här. Personer som redan omfattas […]

Förslag om anpassning av investeraravdraget efter ändrade EU-regler om statligt stöd

Investeraravdrag kan definieras som ett statligt stöd enligt bestämmelserna i fördraget om Europeiska unionens funktionssätt (EUF). Ett beviljat investeringsavdrag innebär att avdrag får göras i inkomstslaget kapital. En proposition som publicerades den 12 mars 2024 har behandlat frågan om anpassning av investeraravdrag med anledning av ändrade EU-regler om statligt stöd. Där föreslås ändringar av inkomstskattelagens […]

Skräddarsydda byggnader tycks äntligen få skräddarsydda regler

Skräddarsydda byggnader inom industrin har sedan länge stått inför en orättvis skattemässig behandling. Orättvisan härrör från skatterättens tillämpning av jordabalkens definitioner. Nyligen publicerades en utredning där uppdraget var att undersöka ifall det finns anledning att se över det skatterättsliga regelverket för de skräddarsydda byggnaderna. Utredningen finner att så är fallet och föreslår regeländringar vilka innebär […]

Viktigt att ta hänsyn till ränteavdragsbegränsningsreglerna i bolagets skatteberäkning

Ränteavdragsbegränsningsreglerna trädde ikraft för lite drygt fem år sedan och innebär i korthet en begränsning av hur stort negativt räntenetto ett bolag eller en intressegemenskap får dra av i sin inkomstdeklaration. Under de senaste åren har räntorna stigit kraftigt, vilket innebär att allt fler bolag måste lämna en bilaga N9 tillsammans med sin inkomstdeklaration. Ränteavdragsbegränsningarna […]

Nu börjar den särskilda fastighetstaxeringen 2024

Nu är det dags för den särskilda fastighetstaxeringen, som i år omfattar hyreshus, ägarlägenheter, industrier, täktmarker, elproduktionslägenheter, specialenheter och lantbruk. Du som äger en nybyggd fastighet eller en fastighet som det skett större förändringar på, och omfattas av den särskilda fastighetstaxeringen, ska lämna deklaration senast den 4 mars. Du som är fastighetsägare lämnar, beroende på […]

Markant ökning av kostnadsräntan på kvarskatt

Kostnadsränta på kvarskatt dubblerades under 2023 och uppgår numera till 5 %. Denna kostnadsränta beräknas på kvarskatt överstigande 30 000 kronor från och med den 13 februari år 2024. Förra årets ökning av kostnadsräntan i kombination med faktumet att kostnadsräntan inte är avdragsgill innebär att det är av särskild vikt för skattebetalare att göra uträkningar och […]

Förtydligande om rätt till grönt skatteavdrag vid installation av batteri för egenproducerad el

Intresset för självförsörjning har ökat de senaste åren och i kombination med höga elpriser väljer allt fler att installera grön teknik för produktion och förvaring av förnybar el. Den 1 januari 2021 trädde det så kallade ”gröna avdraget” i kraft. Detta innebar en möjlighet till skattereduktion avseende kostnader för material och arbete vid installation av […]

Förslag om ändrade underskottsregler

I budgetpropositionen för 2024 framhöll regeringen behovet av förenklingar av reglerna kring underskott vid ägarförändring inom bolagsbeskattningen. Med anledning av det publicerade regeringen den 22 januari tre olika skatteförslag inför höstbudgeten 2024. Regeringen publicerade den 22 januari 2024 tre olika skatteförslag inför höstbudgeten. Ett av förslagen innebär förändrade underskottsregler och regeringens syfte är att nuvarande […]

Ny definition av stadigvarande vistelse?

I slutet av november 2023 lämnade Skatteverket en promemoria till regeringen med ett förslag om att införa en definition av begreppet stadigvarande vistelse i inkomstskattelagen. Stadigvarande vistelse i Sverige medför obegränsad skattskyldighet för fysiska personer och definitionen förslås gälla vid tillämpning av samtliga bestämmelser i inkomstskattelagen där uttryckte stadigvarande vistelse förekommer. Nuvarande definition Stadigvarande vistelse […]

Att tänka på inför årsskiftet 2023/2024

Juletid är kommen och ett nytt beskattningsår väntar runt hörnet. Inför årsskiftet och det nya beskattningsåret finns det vissa punkter som kan vara viktiga att tänka på utifrån ett skatterättsligt perspektiv, både som privatperson och som företagare. I detta blogginlägg ska Mazars Skatt översiktligt redogöra för dessa. Tips för privatpersoner Betala dina fakturor för […]

Skattefrågor i samband med stundande högtider och festligheter

Gåvor och julbord till anställda varierar mellan arbetsgivare. Inför årets slut är det klokt att friska upp minnet kring skattereglerna för sådana förmåner. Att förstå reglerna är viktigt för att undvika skatteproblem och säkerställa överensstämmelse med lagar och regler. Kort sagt, en medvetenhet om skattereglerna är avgörande vid planering av företagets förmåner vid årets avslut. […]

BEFIT – Underlättar EU:s regler för företag med gränsöverskridande verksamhet?

Den 12 september 2023 publicerade EU-kommissionen ett nytt direktiv, BEFIT (Business in Europe: Framework for Income Taxation). Syftet är att minska kostnaderna för regelefterlevnad med upp till 65 procent för koncerner som bedriver gränsöverskridande verksamhet inom EU. Tillvägagångssättet verkar enkelt – reglerna för att beräkna skattebasen ska vara enhetliga. Förslaget i korthet Förslaget innebär att […]

Fåmansföretagare – nu är det tid att se över om du uppfyller lönekravet 2023

Som delägare i ett fåmansföretag har du möjlighet att ta utdelning till låg beskattning upp till ditt gränsbelopp. Om du är delägare i ett fåmansföretag och vill utnyttja företagets löner vid beräkning av gränsbeloppet, krävs att egen eller närståendes lön uppnår en viss nivå, det så kallade löneuttagskravet. I den här artikeln förklarar vi vad […]

Ny lag om tilläggsskatt från årsskiftet – berörs ditt företag?

Den 1 januari 2024 kommer den nya lagen om tilläggsskatt för företag i stora koncerner börja gälla. Regelverket syftar till att motverka skatteplanering med lågskatteländer genom att införa en global minimiskatt om 15 %. Koncerner som berörs kommer att behöva förhålla sig till ett komplext regelverk och nya rapporteringsskyldigheter, och redan i årsredovisningen för räkenskapsåret […]

Betala rätt skatt från början

Om du befarar att du kommer betala för mycket eller för lite skatt på dina inkomster kan du begära jämkning. Något som kan orsaka kvarskatt är om du har inkomster från flera utbetalare, medan exempelvis höga ränteutgifter kan göra att ditt skatteavdrag är för högt. Lämna in din jämkningsansökan senast 19 november för att beslutet […]

Portugal ändrar fokus – avskaffar NHR-reglerna

Sedan 2009 har Portugal genom dess Non-Habitual Resident Regime, så kallade NHR-reglerna, möjliggjort förmånlig beskattning för nyinflyttade personer. I början av oktober meddelade Portugals primärminister, António Costa, att regeringen planerar att avskaffa regelverket från och med årsskiftet. En slutgiltig omröstning kommer ske i slutet av november. Med syfte att stärka landets ekonomi och dess globala […]

Anställd som arbetar på distans från utlandet – i vilket land ska de sociala avgifterna betalas?

Med tanke på en mer flexibel och digitaliserad arbetsmarknad samt ökning av det gränsöverskridande distansarbetet sedan Covid-19, har distansarbete blivit ett alltmer vanligare arbetssätt för många anställda. När man bor i ett land och arbetar i ett annat uppstår ofta frågan om vilket lands sociala trygghetssystem man ska få ta del av. För att samordna […]

FASTER – ett steg på vägen mot en harmoniserad källskattehantering

Den 19 juni presenterade EU-kommissionen ett förslag till direktiv om snabbare och säkrare skattelättnad för överskjutande källskatt s.k. FASTER (Faster and Safer Tax Excess Relief). I förslaget presenteras åtgärder för att underlätta källskattehanteringen för investerare, finansiella mellanhänder och skattemyndigheter i medlemsländerna. Direktivet föreslås vara implementerat 1 januari 2027. Avkastningar från gränsöverskridande kapitalinvesteringar beskattas idag, i […]

Beräkning av anskaffningsvärde när andelar inte längre är näringsbetingade

Skatteverket kom i början av sommaren med ett ställningstagande om beräkning av anskaffningsvärde för andelar och aktiebaserade delägarrätter som upphör att vara näringsbetingade. Huvudregeln är att anskaffningsvärdet beräknas till det ekonomiskt korrekta marknadsvärdet vid det tillfälle aktierna upphör att vara näringsbetingade. I och med ställningstagandet har Skatteverket klargjort sin syn på hur sådan beräkning ska […]

Budgetpropositionen för 2024

Den 20 september presenterade regeringen den nya budgetpropositionen inför kommande år. Propositionen innehåller regeringens förslag på statens budget för år 2024. Förslagen påverkas i stort av det ekonomiska läget – särskilt den rådande inflationen, reformutrymmet samt finansieringsbehovet. I denna artikel ges en överblick av de förslag som presenterades i budgetpropositionen som berör det skatterättsliga området. […]

Ytterligare domstolsavgörande dömer skattetillägg vid ej inlämnad N9-blankett

Den 26 april 2023 meddelade Kammarrätten i Göteborg dom i mål 6567-22. Frågan som behandlades var påförande av skattetillägg när Bolaget inte lämnat in N9-blankett i samband med inlämning av bolagsdeklarationen. Vi har tidigare skrivit om att det kan bli en dyr historia att inte upprätta blankett N9, se tidigare inlägg här. Bakgrund Likt domarna […]

Valutahandel för annans räkning – hur ska inkomsten beskattas?

Skatterättsnämnden lämnade den 11 juli 2023 ett förhandsbesked i en frågeställning som avser hur intäkter som förvärvas genom valutahandel för annans räkning ska beskattas. På en webbplats erbjuds individer möjligheten att delta i valuta- och finansiell instrumenthandel utan att behöva investera mer än en depositionsavgift. Webbplatsen drivs av ett företag hemmahörande i en EU-stat. För […]

Inkomstdeklarationerna är inlämnade – vad händer nu?

Deklarationerna är inlämnade och slutskattebeskedet för de flesta privatpersoner har nu kommit. För att reda ut eventuella frågetecken har Mazars i denna artikel samlat information om viktiga punkter samt datum som är bra att ha koll på, vad gäller efterverkningarna av ditt slutskattebesked. Slutskattebeskedet Slutskattebeskedet innehåller en beräkning av den slutliga skatten och skickas ut […]

Inkomster från uthyrning av tillgångar rapporteras till Skatteverket

Sedan årsskiftet finns nya rapporteringskrav för digitala plattformar till Skatteverket på inkomster från uthyrning av privata tillgångar. Det är viktigt att vara medveten om att uthyrning av privata tillgångar är skattepliktiga och att inkomster från uthyrning som t.ex. sker under sommaren av privatbostäder eller båtar, ska deklareras i inkomstdeklarationen. Från och med 1 januari 2023 […]

Personaloptioner inte skattefria när en ny verksamhet startats i ett gammalt bolag

Skatterättsnämnden har i ett nyligen avgjort förhandsbesked förtydligat vad som gäller för kvalificerade personaloptioner när verksamhet tas över från ett bolag som är äldre än tio år. Frågor som behandlades av nämnden var om de av sökande planerade omstruktureringar, innefattande bland annat fusion, kan till att kraven för kvalificerade personaloptioner är uppfyllda. Allmänt om kvalificerade […]

Internprissättningsdokumentationens vikt för skattetilläggets storlek

I Kammarrättens i Sundsvall dom i mål nr 1850-1851-21 har kammarrätten tagit ställning angående betydelsen av att ha en utförlig internprissättningsdokumentation för beslut om skattetillägg. I detta blogginlägg kommer vi att diskutera bakgrunden i målet, domstolens avgörande och kommentera domens betydelse. Bakgrund Frågan i målet var huruvida moderbolaget (”Bolaget”), som tillhandahöll koncerngemensamma tjänster till sina […]

Granskning av direktpensioner från utlandet

Den 28 april 2023 publicerade Skatteverket information om en genomförd riktad kontroll av direktpensioner från utlandet. Skatteverket har som ett resultat av kontrollen påfört förhöjd skatt och skattetillägg till ett belopp om 50,9 miljoner kronor fördelat på 115 personer. Det är den deklarationsskyldige själv som måste ta upp inkomsten till beskattning. Ett automatiskt informationsutbyte mellan […]

Har du full koll på vilka som ingår i din närståendekrets?

Om du äger andelar i ett s.k. fåmansföretag är det viktigt att ha koll på vilka som ingår i din närståendekrets. Vem du anser som närstående kanske inte stämmer överens med hur inkomstskattelagen tolkar begreppet. Definitionen får betydelse för om en delägares andelar ska anses vara kvalificerade och att utdelning/kapitalvinst därmed till viss del kan […]

Rapporteringsskyldighet för inkomstskattehantering

EU antog 24 november 2021 ett direktiv som syftar till att öka transparensen och insynen i de stora koncernernas skattebetalningar. Genom direktivet kommer företag med intäkter som överstiger 750 miljoner euro behöva rapportera inkomstskatteuppgifter. Syftet är att främja företagens ansvarstagande och möjliggöra för allmänheten att bedöma företagens påverkan på ekonomin. Därav publicerades regeringens lagförslag tidigare […]

Vårbudgetpropositionen och remitterade skatteförslag

Den 17 april presenterade regeringen sin vårbudget för 2023. Budgeten lämnas i ett läge av osäkerhet i flera sektorer, kriget i Ukraina, en ansträngd situation på energimarknaden i Europa och den högsta inflationen i Sverige på över 30 år. Kort efter den presenterade vårbudgeten, remitterades även ett flertal förslag som ska ligga till grund för […]

Inget krav att ha utländska inkomster samma år då avräkning för utländsk skatt begärs

Högsta förvaltningsdomstolen (HFD) meddelade den 16 mars 2023 dom i mål nr 3829–22 avseende avräkning av utländsk skatt. Frågan som behandlades var huruvida en skattskyldig hade rätt till avräkning av utländsk skatt som inte avräknats tidigare år, och om det i så fall krävs att den skattskyldige hade utländska beskattade inkomster det år avräkning begärdes. […]

Förslag om en modernare koncerndefinition

I juni 2022 kom SOU 2022:29 med förslag om en ny modernare koncerndefinition. Om förslaget genomförs medför det en ändring av koncerndefinitionen i årsredovisningslagen, ÅRL. Inom skattelagstiftningen hänvisas det ofta till den aktuella definitionen i ÅRL. En förändring av begreppet kan därmed antas att medföra skatteeffekter. Förslaget innebär huvudsakligen följande förändringar av koncerndefinitionen i ÅRL: […]

Att inte upprätta blankett N9 kan bli en dyr historia

Kammarrätten har i tre olika domar kommit fram till att bolag ska betala skattetillägg efter att de inte upprättat en blankett N9 i samband med deklarationen och därmed dragit av för stor del av bolagets räntekostnader. Ränteavdrag Den 1 januari 2019 trädde de nya ränteavdragsreglerna i kraft. De nya reglerna begränsar hur stor del av […]

Nya aktiebolagsrättsliga omstruktureringsmöjligheter kan leda till anpassning av skattelagstiftning

Från och med den 31 januari 2023 gäller nya aktiebolagsrättsliga regler om gränsöverskridande fusioner, delningar och ombildningar. Till följd av de nya reglerna har Finansdepartementet den 15 mars publicerat en promemoria med förslag om ändringar i bland annat inkomstskattelagen och skatteförfarandelagen, med syfte att anpassa skattelagstiftningen till de förändringar som gjorts i de aktiebolagsrättsliga reglerna. […]

Förslag om implementering av global minimibeskattning i svensk lag

Den 7 februari 2023 lämnade Finansdepartementet delbetänkande avseende implementering av EU:s minimibeskattningsdirektiv i svensk lag. Minimibeskattningsdirektivet, som antogs av EU i december 2022, är en följd av ett omfattande internationellt arbete inom OECD och G20 för att motverka vinstallokering och skatteundandraganden (Pillar II). Direktivet innehåller regler som ska säkerställa att intäkter hos företag som ingår […]

Positivt besked från HFD avseende tolkning av utomståenderegeln

I ett av våra tidigare blogginlägg skrev vi om det förhandsbesked som Skatterättsnämnden lämnade i somras i fråga om utomståenderegelns tillämpningsområde (59-21/D). Frågan som nämnden tog ställning till avsåg huruvida reglerna om samma och likartad verksamhet kunde vara tillämpliga på en situation där passiva investerare tillskjutit medel till verksamhetsbolaget via nyemission. Nämnden fann att reglerna […]

Fråga om beslut att ansöka om permutation för stiftelse har fattats i behörig ordning

Förvaltningsrätten i Stockholm återförvisar ärende om ändring av ändamål för en stiftelse till Kammarkollegiet för prövning i sak. Bakgrund I målet hade två företrädare för stiftelsen med stöd av fullmakt från SEB:s styrelse (förvaltare) fattat beslut om att ansöka om ändring av stiftelsens stadgar. Ansökan avsåg att ändra stiftelsens ändamål, s.k. permutation. Kammarkollegiet som hanterar […]

Utredning om exitskatt läggs ner

Nuvarande regering har lagt ner den utredning om exitskatt som tillsattes av den föregående regeringen. Tioårsregeln kommer därmed fortsatt att gälla så som bestämmelsen ser ut idag. Den tidigare S-regeringen tillsatte en utredning under 2022 om exitskatt (läs mer om utredningen i vårt tidigare blogginlägg som du hittar här), där förslagets syfte var att se […]

Vad gäller för deklarationen för 2022?

När får jag min deklaration? Vad ska jag tänka på om jag behöver göra en fyllnadsbetalning? Är det något speciellt som jag måste tänka på när jag deklarerar för ett aktiebolag? För en hel del människor innebär deklarationen fler frågetecken än svar. För att hjälpa till att reda ut dessa frågetecken har Mazars i denna […]

Utredning av 3:12-reglerna – uppdraget ändras och utökas i tilläggsdirektiv

Den förra regeringen tillsatte en utredning den 25 maj 2022 om en översyn av de så kallade 3:12-reglerna. Utredningen innebär att en kommitté ska ge förslag på vilka möjligheter det finns för att förenkla de särskilda reglerna för utdelning och kapitalvinst på andelar i fåmansföretag, de s.k. 3:12-reglerna. Den sittande regeringen har nu i ett […]

Utökade möjligheter till tillfälligt anstånd med inbetalning av skatt

En stödåtgärd som, i kölvattnet av Covid-19, fortfarande lever vidare är tillfälligt anstånd med inbetalning av skatt. Förutsättningarna för den europeiska energimarknaden har under den senaste tiden kraftigt ändrats och svenska företag står nu inför mycket högre energipriser än tidigare, vilket ger ökande produktionskostnader som kan vara svåra att hantera. Som en åtgärd för att […]

Högsta förvaltningsdomstolen undanröjer skattetillägg efter helomvändning av Skatteverket

Högsta förvaltningsdomstolen (HFD) har i en dom den 3 januari 2023 (mål nr. 3365-22) fastslagit att en förlust på ett skuldebrev som erhållits som betalning vid en överlåtelse av näringsbetingade andelar, inte omfattas av avdragsförbudet i 25 a kap. 19 § första stycket 4 inkomstskattelag (1999:1229), IL. Skatteverket överklagade kammarrättens dom, trots att Skatteverket vunnit […]

Kontaktad av Skatteverket eller Tullverket? Forvis Mazars processgrupp hjälper dig!

Skattelagstiftningen är komplex och det är inte alltid lätt att veta hur en viss fråga ska bedömas. När en deklaration lämnas in till Skatteverket och Skatteverket bedömer att deklarationen är fel eller när det i en upplysning till en deklaration saknas information för att Skatteverket ska kunna bedöma en fråga på ett korrekt sätt, kan […]

God Jul och Gott Nytt År

– och tack för att du läser vår blogg. Istället för att ge julklappar och skicka julkort till våra kunder och samarbetspartners har vi på Mazars valt att ge en julgåva till Stadsmissionen i Stockholm, Göteborg och Skåne. Genom deras fantastiska arbete vill vi bidra till att människor och familjer som lever i utsatthet får […]

Prövningstillstånd meddelat i mål om Tull och tillfällig införsel – Mazars biträder den klagande

Ett företag påfördes tull och moms efter en tillfällig införsel av en dragracingbil. Högsta förvaltningsdomstolen (HFD) har meddelat prövningstillstånd för att pröva hur artikel 251 i tullkodex ska tolkas. Mazars processgrupp biträder företaget i processen. Ett bolag hade tagit in en dragracingbil på tillfällig införsel till Sverige. Syftet var att bolaget skulle tävla med bilen […]

Ingen skatt vid överföring av teckningsoptioner i samband med personaloptioner

Skatterättsnämnden meddelade den 7 november ett förhandsbesked avseende beskattning där ett bolag planerar överföra teckningsoptioner som ett första steg i nyttjandet av en så kallad kvalificerad personaloption. Reglerna om kvalificerade personaloptioner innebär att någon förmån av personaloption inte ska tas upp till beskattning under förutsättning att vissa villkor är uppfyllda. Vi har i tidigare blogginlägg […]

Kan lämnade koncernbidrag anses utgöra skatteflykt?

Skatterättsnämnden har i förhandsbesked 28-22/D fastslagit att avdrag för koncernbidrag till ett bolag som året efter koncernbidraget har avyttrats, inte anses kunna vägras med stöd av skatteflyktslagen. Bolaget X ägde samtliga aktier i dotterbolaget Å, vilket i januari 2022 överläts till en extern köpare. Vid ingången av beskattningsåret 2021 fanns det outnyttjade underskott från tidigare […]

Värdeöverföring från fåmansföretag är inte att likställa med överlåten rätt till utdelning

Skatterättsnämnden har lämnat ett förhandsbesked den 20 september 2022, 39-22/D, som fastställde att värdeöverföringar beslutade av ett fåmansföretag inte har ansetts kunna jämställas med att aktieägaren överlåtit rätten till utdelning. Omständigheterna i förhandsbeskedet gällde A som är ägare till fåmansbolaget X AB, som är ett kupongbolag och som i sin tur är delägare i Y […]

Skattenyheter i budgetpropositionen för 2023

Den 8 november 2022 lämnades budgetpropositionen för 2023 över till riksdagen. Av propositionen framgår regeringens förslag på reformer och åtgärder med syfte att stötta svenska hushåll och företag, åtgärder för en mer fossilfri elproduktion och minskade utsläpp m.m. Målet är att Sverige ska möta utmaningar som lågkonjunktur och inflation med en balanserad och ansvarsfull finanspolitik […]

Vår blogg – Mazars Sweden News – fyller 2 år!

Nu är det 2 år sedan vi publicerade vårt första blogginlägg – och ännu fler blir det! Här på vår blogg hittar du allt från information om incitamentsprogram, ränteavdragsbegränsningar och värdering av företag, till uppdateringar om nya lagförslag och aktuella rättsfall. Inläggen skrivs av våra skattejurister som alla dagligen arbetar med rådgivning och processhantering rörande […]

Har du en plan för ägarskiftet av ditt bolag?

Har du tankar kring vad som är nästa steg för ditt bolag? Om det finns en tanke på att göra verklighet av pensionsdrömmen inom ett par år så är det en sak som du ska tänka på: ha en plan. Det finns många viktiga frågor inför den här typen av överlåtelse, inte minst ”hur blir […]

Höjd ränta på skattekontot – betala din kvarskatt före den 1 november

Från och med den 1 november höjer Skatteverket räntan på kvarskatt och anstånd med skatt, från 1,25 procent till 2,5 procent. Samtidigt kommer det för första gången sedan 2017 att utgå intäktsränta på skattekontot om 1,125 procent. Anledningen till höjningen av kostnadsräntan är att den genomsnittliga säljräntan för sexmånaders statsskuldväxlar, som skattekontot bestäms utifrån, har […]

Maximera möjligheten till lågbeskattad utdelning från ditt fåmansaktiebolag

För att en delägare i ett fåmansföretag ska få utnyttja företagets löner vid beräkning av årets gränsbelopp krävs att utbetalda löner uppgår till vissa belopp. Har rätt lön tagits ut i företaget under 2022? Vi reder ut och förtydligar vad man bör tänkta på i samband med årets sista löneutbetalningar. Om en delägare, eller dess […]

Skattemässig avdragsrätt för CSR-kostnader

Att ekonomi och hållbarhet är något som hör ihop har blivit allt tydligare under senare år. I dag ser företagen socialt ansvarstagande (CSR) som en viktig del i att skapa förtroende för sitt varumärke. Som en förlängning av det ser vi ett ökat intresse – från såväl företag som investerare, kunder och andra intressenter – […]

DAC 7 – Hög tid att förbereda sig inför det nya rapporteringskravet

Enligt ett nytt EU-direktiv, DAC 7, kommer plattformsoperatörer att vara skyldiga att rapportera om säljare som använder plattformen. Direktivet omfattar företag som gör digitala plattformar tillgängliga för andra att förmedla varor och tjänster. Syftet med rapporteringskravet är att medlemsstaterna enklare ska kunna identifiera beskattningsbara inkomster. Reglerna träder i kraft den 1 januari 2023. Vilka företag omfattas? Rapporteringskravet […]

Nya regler för tryggare bostadsrättsköp träder i kraft efter årsskiftet

Den 14 juni 2022 beslutade riksdagen att införa flera ändringar i bostadsrättslagen. Syftet med ändringarna är att stärka det rättsliga skyddet både för den som köper en nyproducerad bostadsrätt men även för bostadsrättsägare i allmänhet. I detta blogginlägg sammanfattas de viktigaste förändringarna som riksdagen presenterat vad gäller skärpta krav på förhandsavtal och upplåtelseavtal samt regeländringarna […]

Förändrad tolkning av utomståenderegeln enligt nytt förhandsbesked från Skatterättsnämnden

Under sommaren kom ett förhandsbesked från Skatterättsnämnden, 59–21/D, som fastställde att utomståenderegeln inte var tillämplig. Detta eftersom risken för inkomstomvandling måste beaktas vid bedömning av samma eller likartad verksamhet. Att det i rådande fall inte föreligger någon risk för inkomstomvandling ändrar enligt nämnden inte bedömningen. Enligt 3:12-regleverket ska utdelning och kapitalvinst på kvalificerade andelar i […]

Rekordhöjning av prisbasbeloppet för 2023

Det nyligen fastställda prisbasbeloppet som börjar gälla 1 januari 2023 kommer att påverka socialförsäkrings- och skattesystemen. Vi beskriver vad denna rekordhöjning har för effekter i detalj. Regeringen meddelade den 5e september att man har beslutat att höja prisbasbeloppet till 52 500 kr för 2023. Denna höjning motsvarar 8,7% från föregående år vilket innebär den högsta höjningen […]

Nya lagar som träder i kraft under sommaren

Under sommarperioden träder ett flertal nya lagar i kraft, som tidigare aviserades i budgetpropositionen under hösten 2022. För att ni ska hålla er uppdaterade så har vi på Mazars valt att presentera ett urval av de nya lagar och regler som trätt i kraft, vilket kan påverkar både dig som företagare och privatperson. Sänkt mervärdesskatt […]

Vinnaren i Mazars tävling på Borgeby Fältdagar

Mazars vill tacka alla som kom och besökte vår monter under Borgeby Fältdagar. Under dagarna pågick ett intensivt tävlande i vår monter och vinnaren av priset; en Farm Cam HD, blev Christina Segerslätt. ”Vad kul! Det kan behövas lite extra övervakning på en gård så det kommer väl till pass”, sa en glad Christina när […]

Spel- och tävlingsvinster – skattefria eller inte?

Det är nog inte många som tackar nej till en vinst, men har du koll på eventuella skattekonsekvenser? Vinstskatt kan tillkomma i olika sammanhang och när det kommer till vinster som erhålles vid spel och tävling finns det vissa avgörande förutsättningar för att vinsten ska ses som en skattefri eller skattepliktig inkomst. I Inkomstskattelagens 8:e […]

Förslag till nytt regelverk för källskatt på utdelningar till utländska personer skickas på remissrunda – är vi ett steg närmare nya regler?

Den 7 juni meddelade Finansdepartementet att den tidigare publicerade promemorian ”Ny lag om källskatt på utdelning” har skickats ut på en remissrunda. Det är totalt 36 remissinstanser som ska lämna sina åsikter avseende hur nya regler avseende källskatt på utdelning till utländska personer kan komma att se ut. Sista dagen för remissinstanserna att inkomma med […]

Hemarbetets innebörd för ett fast driftställe

Den 13 maj 2022 publicerade Skatteverket ett nytt ställningstagande avseende hemarbetets betydelse för att ett fast driftställe ska kunna uppstå. Vi har fått mer klarhet i när ett fast driftställe kan uppkomma och ställningstagandet, som ersätter Skatteverkets tidigare ställningstagande från 2015, är välkomnat i en tid då allt fler både jobbar hemifrån och från länder […]

Nya utredningar – Förenklade regler för fåmansföretag och exitbeskattning

Regeringen meddelade den 25 maj att två nya utredningar rörande skatteregler kommer att tillsättas. Den första utredningen syftar till att förenkla reglerna för utdelning och kapitalvinst på andelar i fåmansföretag, medan den andra utredningen syftar till att säkerställa en effektiv beskattning av kapitalvinster som upparbetats i Sverige, vid flytt utomlands. Frågeställningarna i båda förslagen har […]

Träffa Mazars på Borgeby Fältdagar 29–30 juni 2022

Lantbruksmässan Borgeby Fältdagar i skånska Bjärred lockar årligen ca 20 000 besökare som vill ta del av maskindemonstrationer, växtodlingsförsök, seminarier och intressanta utställare. I år är fältdagarna den 29–30 juni och Mazars är en av utställarna. Under fältdagarna träffar du Mazars lantbrukskunniga revisorer, redovisningsekonomer och skattejurister i monter S79. Kom och prata med oss och ställ […]

Avståndsbaserad men inte kostnadsbaserad skattereduktion för resor till och från arbete

De nuvarande reglerna för avdrag för resor till och från arbete gynnar inte kollektivtrafiken. För att kunna gynna kollektivtrafiken har regeringen lagt fram ett förslag som ska göra det neutralt mellan färdmedlen. De skattemässiga reglerna avseende avdrag för resor till och från arbetet är enligt nuvarande utformning baserade på den faktiska kostnaden för att transportera […]

Uppdaterade riktlinjer från OECD – Transfer Pricing Guidelines 2022

OECD publicerade nyligen en ny upplaga av riktlinjerna för internprissättning för multinationella företag och skatteförvaltningar, som ersätter den tidigare utgåvan från 2017. OECD:s riktlinjer för internprissättning ger vägledning om tillämpningen av ”armlängdsprincipen”, som representerar den internationella konsensusen om värdering för inkomstskatteändamål av gränsöverskridande transaktioner mellan associerade företag. I dagens ekonomi där multinationella företag spelar en […]

Incitamentsprogram – en framgångsfaktor

För de allra flesta företag är de anställda en av de viktigaste tillgångarna i verksamheten. Med anledning därav är det viktigt att attrahera, motivera och bibehålla nyckelanställda i företaget. Att implementera ett incitamentsprogram för företagets nyckelanställda kan därmed vara en framgångsfaktor. Kortfattat innebär ett incitamentsprogram att företaget låter de anställda förvärva olika finansiella instrument från […]

Sänkt skatt på diesel inom jord- och skogsbruk samt vattenbruk föreslås i vårbudgeten 2022

Den 19 april lämnade regeringen sin vårändringsbudget till riksdagen. I budgeten presenteras ett förslag om en tillfällig skattenedsättning på diesel och ett stöd för jord- och skogsbruk, som likt de svenska hushållen påverkats av de ökade drivmedelspriserna. De nya förslagen som presenteras i vårbudgeten motiveras både av den pandemi vi har levt med i två […]

Väsentligt inflytande över näringsverksamhet i Sverige medförde inte väsentlig anknytning

Den 24 mars 2022 publicerade Skatterättsnämnden ett förhandsbesked avseende huruvida ett indirekt aktieinnehav i verksamhetsdrivande svenska aktiebolag anses medföra väsentlig anknytning till Sverige. Skattskyldighet på grund av väsentlig anknytning regleras i 3 kap. 7 § inkomstskattelagen (IL). Vi har i ett tidigare blogginlägg berört frågan när en person anses vara obegränsat skattskyldig på grund av […]

Stämpelskatteutredningen har landat – Lantmäteriet föreslår nya regler för att minska kringgåenden av stämpelskatt

Lantmäteriet har sedan 2020 haft i uppdrag att undersöka huruvida det finns möjlighet att införa en generell stämpelskatteplikt vid förvärv av fast egendom genom fastighetsbildningsåtgärder alternativt lämna förslag som motverkar att stämpelskatteplikten kringgås. Lantmäteriet publicerade 1 april 2022 dess rapport som sammanfattas enligt nedan. Bakgrund till behovet av en generell stämpelskatteplikt vid förvärv av fast […]

Pension från utlandet? – Undvik kostsamma misstag i deklarationen

Närmare 70 procent av de avslutade utredningar som Skatteverket utfört, visar att tjänstepension som erhålls från utlandet deklareras fel eller inte alls. Skattemyndigheter världen över har ett nära samarbete. Sverige är ett av de land som deltar aktivt genom att inhämta och dela kontrolluppgifter med andra länder. Under 2021 gjordes en riktad kontroll mot personer […]

Hur hanteras donationer för privatpersoner och fåmansföretag?

I samband med krisen i Ukraina väljer både företag och privatpersoner att lämna donationer till olika välgörenhetsorganisationer. Som aktieägare i ett fåmansföretag kan du välja att skänka din rätt till utdelning skattefritt och som privatperson har du rätt till en skattereduktion i din inkomstdeklaration när du skänker ett bidrag till en ideell förening, stiftelse eller […]

Utländska företags skyldighet att lämna uppgifter till Skatteverket

Den 1 januari 2021 infördes nya regler avseende rapportering av särskilda uppgifter till Skatteverket för vissa utländska företag som saknar ett fast driftställe i Sverige och som (1) betalar ut lön till anställda som arbetar i Sverige, eller (2) fakturerar ett annat företag för arbete här i Sverige. De nya reglerna innebär att särskilda uppgifter ska […]

Har du koll på vad som gäller för deklarationen för 2021?

När får jag min deklaration? När ska den vara inlämnad till Skatteverket? Är det något speciellt som jag måste tänka på när jag deklarerar för ett aktiebolag? För en hel del människor innebär deklarationen fler frågetecken än svar. För att hjälpa till att reda ut dessa frågetecken har Mazars i denna artikel samlat information kring […]

Alla pratar om den Gröna Taxonomin – men hur påverkar den dig?

EU-taxonomin, eller den ”Gröna Taxonomin”, är ett ramverk för hållbara investeringar och finanser. Tanken är att underlätta för investeringar i hållbar teknik och hållbara företag, för att bidra till ett klimatneutralt Europa år 2050. Taxonomin innehåller mätbara krav som kommer att hjälpa investerare och andra intressenter att förstå om en ekonomisk aktivitet, enligt taxonomin, är […]

ATAD 3 – potentiellt högre krav på minimal substans och ekonomisk verksamhet för alla bolag inom EU

EU-kommissionen har nyligen lämnat förslag på ett nytt skatteflyktsdirektiv, även benämnt som ATAD 3, som är tilltänkt att träda i kraft den 1 januari 2024. Syftet med direktivet är att förebygga missbruk, genom skalbolag, inom EU för skatteändamål. Detta för att möjliggöra en effektiv beskattning och att jämnt fördela skattebördan för bolag mellan medlemsstaterna. Förslaget […]

Stiftelse bedöms oinskränkt skattskyldig (främjande av miljövård)

Förvaltningsrätten i Stockholm anser att en stiftelse, som nationellt och internationellt tar fram resurser för att sprida kunskap om och stödja åtgärder för bevarande, skapande och skötsel av våtmarker samt produktions-, rast- och övervintringslokaler för fåglar, inte främjar ett allmännyttigt ändamål enligt 7 kap. 4 § inkomstskattelagen (IL) (Förvaltningsrätten i Stockholms dom meddelad den 10 […]

Att värdera ett företag

Vid värdering av ett företag finns flera faktorer att ta hänsyn till och det kan vara svårt att avgöra vilka som bör beaktas. I denna artikel har vi sammanställt de vanligaste momenten vid en företagsvärdering och ger tips på faktorer som är bra att tänka på. De vanligaste faktorerna som analyseras vid en företagsvärdering är […]

Kan hemmaarbete påverka ditt tjänsteställe?

Vår arbetssituation blir mer och mer digital, med elektroniska dokument, möten på distans och en önskan om att kunna styra sin egen tid. Pandemiåren har verkligen skyndat på denna utveckling och många har nu bildat sig en ny vardag med hemmakontor och flexiblare dagar. Men kan arbete hemifrån påverkar var du kan anses ha ditt […]

Högsta förvaltningsdomstolen slår fast att anstånd kan medges för moms som ska betalas tillbaka

I dom den 10 januari 2022 slår Högsta förvaltningsdomstolen (HFD) fast att reglerna om anstånd med betalning av skatt även gäller moms som Skatteverket kräver tillbaka av en skattskyldig. Mazars var ombud för den skattskyldige. Fallet handlar i grunden om ett aktiebolag som nekats avdrag för ingående moms av Skatteverket. Bolaget överklagade Skatteverkets beslut till […]

Skatteverkets fokus vid vinstallokering till fasta driftställen i Sverige

Hur vinstallokering sker till fasta driftställen i Sverige har blivit ett tydligt fokusområde som Skatteverket granskar. Det har kommit en del rättsfall på området och vi vill därmed belysa problematiken i det här blogginlägget. Hur en vinstallokering ska gå till I OECD:s vinstallokeringsrapport från 2010 ges vägledning kring hur man ska bestämma den inkomst som […]

Julgåvor och julbord till anställda

Hur en julgåva eller ett julbord erbjuds till anställda skiljer sig såklart åt mellan olika arbetsgivare och bolag. Nu när året lider mot sitt slut kan det därför vara bra att bli påmind om de skatteregler som gäller. För 2021 gäller dessutom en något högre beloppsgräns för skattefri julgåva än tidigare år. Julgåva till anställda […]

Ja till gemensamt budgetförslag från M, SD och KD – delvis ändrade skatteförslag

Den 25 november röstade riksdagen för det gemensamma budgetförslag som lämnats av M, SD och KD. Statsbudgeten utgår från regeringens budgetproposition, med vissa justeringar. Sammanfattningsvis röstade riksdagen för följande lagändringar som börjar gälla från och med 1 januari 2022. Grundavdraget höjs för personer över 65 år Sänkt skatt för pensionärer (ca 1 800 kr lägre […]

Utlåning av kryptovaluta ska beskattas som avyttring

Det kan inte ha undgått någon att antalet kryptotillgångar och sätten att använda dessa på har ökat markant senaste tiden. Kryptovalutor är inte längre något nytt fenomen, men rättsläget är alltjämt oklart och många har ställt sig frågande till den skattemässiga hanteringen av nu vanligt förekommande transaktioner så som exempelvis staking och likviditetspooler. I ett […]

Översyn av de nya skattereglerna för företagssektorn som trädde i kraft 1 januari 2019

En särskild utredare har tillsatts av Finansdepartementet som ska följa upp och se över vissa frågor med anledning av de ränteavdragsregler som trädde i kraft den 1 januari 2019. Det var i samband med när de nya ränteavdragsreglerna trädde i kraft som regeringen aviserade att de inom en tvåårsperiod skulle göra en översyn över reglerna. […]

Är Du delägare i ett fåmansföretag? Då är det hög tid att stämma av att Du uppfyller lönekravet 2021.

Det börjar återigen närma sig den där tiden på året när matbutikerna fyller hyllorna med både lussekatter och tomteskum och radion spelar de första tonerna av Mariah Careys klassiska hitlåt ”All I want for christmas is you”. Ja, då vet man att nu är det hög tid för Dig som är ägare i fåmansföretag att […]

Avståndsbaserad och färdmedelsneutral skattereduktion väntas subventionera framtidens arbetsresor

I juni 2019 överlämnade Reseavdragskommittén sitt betänkande Skattelättnad för arbetsresor (SOU 2019:36) där kommittén föreslog att dagens reseavdrag ska ersättas med en avståndsbaserad och färdmedelsneutral skattereduktion för arbetsresor. Enligt Skatteverkets beräkningar för åren 2014–2016 uppgick skattefelet för reseavdrag till 1,8 miljarder kronor per år, vilket motsvarar en tredjedel av reseavdragets skattemässiga värde. Under de senaste […]

Förhandsbesked om tidpunkten då mark ändrar karaktär till byggnadstomt i en tomtrörelse

Skatterättsnämnden har den 21 september lämnat förhandsbesked i en fråga avseende tomtrörelser där rättsläget bedöms vara oklart, SRN 30-21/D. Frågan, som varken besvaras i lagtext eller genom förarbetsuttalanden, är vid vilken tidpunkt som tillkommande tomter till en tomtrörelse ändrar karaktär från att vara mark till att bli byggnadstomt och därmed lagertillgångar i pågående tomtrörelse. Frågan […]

Den digitala ekonomin tvingar skattkartan till ett rejält (ansikts)lyft

Den 1 juli presenterade OECD en översiktsplan för beskattning av den digitala ekonomin samt införandet av en global minimiskatt. Sedan finanskrisen 2007 har den internationella fejden om skattebaserna stegrats upp avsevärt. I takt med att nya digitala affärsmodeller ökar markant, ökar även trycket på huruvida tillämpningen av befintliga beskattningsprinciper kan tillämpas på den digitala ekonomin. […]

Från förslag till lag – Riksdagen har fattat beslut om förslaget avseende skattereduktion för investeringar i inventarier under 2021

Riksdagen har beslutat att anta förslaget om en tillfällig lag som ger möjlighet till skattereduktion för investeringar i inventarier som anskaffats under kalenderåret 2021. Vad innebär de nya reglerna? Både fysiska och juridiska personer har rätt till skattereduktion under förutsättning att de har ett underlag för skattereduktion. Underlaget för skattereduktionen utgörs av anskaffningsvärdet för inventarier […]

Förändringar i regelverket kring källskatt på utdelningar till utländska personer

Den 20 september 2021 lämnade regeringen budgetpropositionen för 2022 till riksdagen. Propositionen innehöll bland annat en ny lag om källskatt på utdelning som medför att nuvarande Kupongskattelagen (1970:624) upphävs, för att ersättas med det nya förslaget. Förslaget föreslås att träda i kraft den 1 juli 2023. Förslaget är en utveckling av regeringens tidigare planer som presenterades […]

Aktiebolag bedöms utgöra allmänt undervisningsverk – fråga om inskränkt skattskyldighet

I Högsta förvaltningsdomstolens (HFD) dom meddelad den 28 september 2021, mål nr. 5952-20, bedöms ett bolag utgöra ett allmänt undervisningsverk som är inskränkt skattskyldig. HFD fastställer därmed Skatterättsnämndens förhandsbesked meddelat genom beslut den 30 september 2020 i ärende med dnr 17-20/D. Förutsättningarna i förhandsbeskedet Förhandsbeskedet som HFD nu fastställer gäller en ideell förening, Evangeliska Fosterlands-Stiftelsen […]

HFD slår fast att en momsregistrering innebär rätt till momsavdrag – ny dom i HFD där Mazars var ombud för den skattskyldige

Målet gäller ett aktiebolag som bedriver sjukvård men även hästförsäljning och därmed förenlig verksamhet. 2014 godkände Skatteverket bolagets ansökan om momsregistrering för hästverksamheten. Under 2017 fann Skatteverket att hästverksamheten inte uppfyllde kraven för att vara en momspliktig verksamhet. Skatteverket ansåg därför att bolaget inte hade rätt till de momsavdrag som bolaget tidigare hade gjort i […]

Regeringen föreslår en utvidgning av reglerna om lättnad i beskattningen av kvalificerade personaloptioner

Den 20 september lämnade regeringen sin budgetproposition för 2022 till riksdagen. I budgetpropositionen föreslår regeringen att de nuvarande bestämmelserna om lättnad i beskattningen av kvalificerade personaloptioner både ska utvidgas och förenklas. Bestämmelserna föreslås träda i kraft den 1 januari 2022. Bestämmelserna om kvalificerade personaloptioner innebär att nystartade företag inom visa branscher, och förutsatt att vissa […]

Skattenyheter i budgetpropositionen för 2022

Igår, 20 september, lämnade regeringen budgetpropositionen för 2022 till riksdagen. Regeringen lägger tyngden i propositionen på en snabbare klimatomställning, att fler ska komma i arbete och att välfärden ska stärkas. Många av de nu aviserade förslagen har tidigare presenterats i olika pressmeddelanden, men nu kommer alltså förslagen i sin helhet. På skatteområdet föreslås bland annat […]

Självständigt bedriven näringsverksamhet

Skatterättsnämnden meddelade den 1 juli 2021 ett förhandsbesked avseende kravet på självständighet när en anställd övergår till att bedriva verksamhet i ett eget aktiebolag. Kravet på självständighet återfinns i 13 kap. 1 § 1 st. i inkomstskattelagen (IL). Enligt paragrafens andra stycke framgår att vad som avtalas med uppdragsgivaren, i vilken omfattning uppdragstagaren är beroende […]

Nya lagar från 1 juli

Många av de förslag på nya lagar och förordningar som vi har skrivit om under våren, träder nu i kraft. Det handlar bland annat om det förstärkta avdraget för nedsättning av arbetsgivaravgifter för anställda som arbetar med forskning och utveckling, justerad bilförmånsberäkning och ändrade regler för moms vid e-handel. FoU-avdraget förstärks ytterligare En arbetsgivare som […]

Eventuellt införande av stämpelskatt vid förvärv av fast egendom genom fastighetsbildningsåtgärder

Regeringen har gett Lantmäteriet i uppdrag att utreda om marköverföringar genom fastighetsbildningsåtgärder ska vara stämpelskattepliktiga. Lantmäteriet ska utreda om det finns förutsättningar för att införa generell stämpelskatteplikt för förvärv av fast egendom genom fastighetsbildning på samma sätt som vid förvärv genom exempelvis köp eller byte. Om det saknas förutsättningar för att införa en generell skatteplikt […]

Vad gäller vid värdeöverföringar genom underprisöverlåtelse i samband med paketering av näringsbetingade aktier?

När ett aktiebolag överlåter näringsbetingade aktier är vinst skattefri och förlust ej skattemässigt avdragsgill. Överlåts näringsbetingade aktier för underpris till annat aktiebolag, utan att det sker någon förmögenhetsöverföring mellan fysiska personer som, direkt eller indirekt, är ägare till överlåtande respektive förvärvande bolag, medför inte heller överlåtelsen någon beskattning av dessa personer. Regler tillämpas ofta i […]

Stopplagstiftning avseende handel med underskottsföretag

Regeringen presenterade igår, den 10 juni 2021, ett förslag om en särskild begränsningsregel för underskott från tidigare år. Syftet med regeln är att motverka handel med underskottsföretag och att beloppsspärren kringgås. I korthet innebär förslaget att möjligheten att utnyttja tidigare års underskott upphör efter en ägarförändring, om underskotten med hänsyn till omständigheterna kan antas ha […]

Beslut om uttagsbeskattning där bolagets kostnader översteg försäljningsvärdet upphävs

Bolaget hade kostnader som uppgick till 45 mkr för uppförandet av de sålda byggnaderna, men överlät byggnaderna för 17 mkr. Enligt Skatteverket såldes byggnaderna till underpris eftersom ersättningen understeg de nerlagda kostnaderna. Beslutet upphävdes i en av kammarrätten nyligen avgjord dom. Bolagets indirekta ägare var syskon med varandra och överlåtelsen av byggnaderna skedde till deras […]

DAC7 – Nya rapporteringskrav för digitala plattformsoperatörer

EU-rådet har nyligen antagit nya regler som från och med den 1 januari 2023 börjar gälla för digitala plattsformsoperatörer. Reglerna införs för att förenkla administrativt samarbete och informationsutbyte mellan EU:s medlemsländer. Reglerna, som kallas DAC7 och till stor del bygger på OECD:s modellregler på samma område, införs som ett tillägg till Rådets direktiv 2011/16/EU (DAC) […]

Kryptovalutor – en teknisk och skatterättslig djungel

Deklarationssäsongen är i full gång och att vi har tagit emot en mängd frågor om hur just kryptovalutor ska hanteras skattemässigt. Måste man skatta om man har betalat en vara med bitcoin? Måste man skatta om man har växlat litecoin mot bitcoin? Får man dra av hela förlusten vid en försäljning? Hur redovisar jag mina […]

Utvidgad fåmansföretagsdefinition och utomståenderegeln